Please raise your hand if you've ever felt overwhelmed by the plethora of metrics provided within your reporting software - website visits, conversion rates, generated leads per channel, engagement on social media platforms, blog post shares, email click-through rates, etc. Most of the popular reporting software packages come preset to calculate vanity metrics. This data is great and will boost your confidence in your efforts, however it does not provide clear guidance indicating if your business is moving in an upward direction. For example, this is a screenshot of the default dashboard from Google Analytics.

Well, there’s good news: if your marketing efforts are directed towards driving your business and/or revenue growth, there are two essential, actionable metrics that can be used - customer lifetime value (LTV) and cost of customer acquisition (CAC). We will walk through the process on how to track these metrics right now in this very blog post. When we are all done, you will know exactly how to use these data points to answer this question: Do we reflect a profit made on the cost of the initial customer acquisition? Ready?! Let’s dive in!

Customer Lifetime Value (LTV)

LTV calculates how much revenue we expect to receive in the future from our customers. There are a number of formulas for calculating this metric, some of which are pretty intense. I prefer to start with the simplified equation and then adjust as needed, given the business model.

To calculate LTV, take the average revenue the customer pays in a period, subtract gross margin, and then divide by the estimated churn percentage for that customer.

Keep in mind that you want to calculate this metric for different customer groups (called cohorts). This number tells you the market segment(s) that provide the highest marketing ROI. Essentially, LTV steers your marketing campaigns.

Cost of Customer Acquisition (CAC)

Marketing takes a large investment of both your time and money. Acquiring customers through inefficient channels will destroy your margins. To mitigate this risk, track the CAC of each of your marketing campaigns. CAC is the total average cost your company spends to acquire a new customer.

To calculate CAC, take your total sales and marketing spend, and divide by the number of new customers acquired for that specific time period. Your Sales and Marketing Costs consist of the following elements: Program and advertising spend, employee salaries, commissions and bonuses, and overhead that has incurred within that time period. Your New Customer metric is the number of new customers in a month, quarter, or year. For example, if your Sales and Marketing Costs for the month are at $100,000 and you acquired 10 new customers that same month, the CAC is at $10,000 per customer.

Obviously, you want to acquire customers through the most cost effective channels. Sales and marketing inefficiency will result in an increase in CAC. Use this metric to determine if pursuing new acquisition channels are worth the effort.

Lifetime Value to Cost of Acquisition Ratio (LTV:CAC)

Last, but certainly not least, you want to calculate LTV:CAC. This metric shows how much value you derive from a customer in relation to what costs you incurred in order to acquire that customer. In doing so, you will determine what levers to pull that will drive overall business and revenue growth.

To find this actionable metric, find the ratio of LTV to CAC needs to be calculated.

A five-time entrepreneur turned VC at Matrix Partners, David Skok, states that a successful business (especially SaaS) will have a ratio higher than a 3. A good rule of thumb for most business models is to keep this ratio around 3:1. You need a healthy balance between profitability and company growth. If this ratio is too high, not investing enough resources to reach new customers.

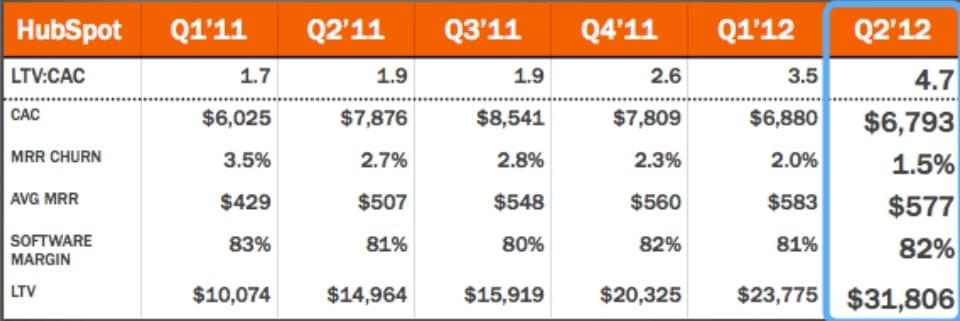

Let’s look at a real life example from HubSpot, published in Forbes.

HubSpot significantly improved their LTV:CAC for this time period. The driver here was lowering their monthly recurring revenue (MRR) churn rate, driving up LTV.

To review, you’ve just learned how to study the unit economics of each customer:

- LTV = (Average Revenue per Customer - Gross Margin) / Customer Churn Rate

- CAC = Sales and Marketing Costs / Number of New Customers

- LTV:CAC = LTV / CAC

Now you’re ready to start tracking these metrics and answer the question, “Can I make more profit from my customers than it costs me to acquire them?”

When reporting on performance, you want to tell a compelling story that the C-suite can get excited about. LTV and CAC tells a story of the impact that marketing has on the business. Report on how the marketing program led to acquiring more profitable customers at a lower cost. This type of reporting will resonate with the key stakeholders and provides leaders with the information to make data-influenced decisions.

Want to learn about the actionable metrics that drive the needle of your business forward? Download our free eBook, “6 Marketing Metrics Your Boss Needs to Know!”

Photo credit: James Royal-Lawson